|

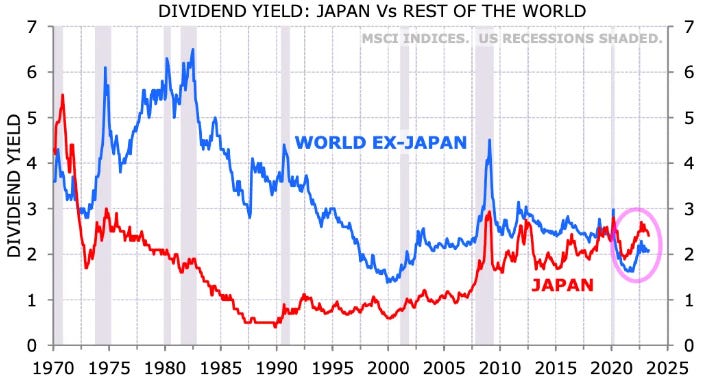

10k Words Equitable Investors May 2023 Changes in the cost of capital remain front and centre with Japan's dividend yield surpassing the rest of the world's for the first time in 50 years and asset class yields converging as fund managers express bullishnes on bonds, with 30+ countries facing inverted yield curves and the futures market still pricing a decline in the Fed Funds rate. It is amazing how even having the ticker "AI" has been enough to attract buyers. Amidst such sentiment, Nvidia has joined the trillion dollar market cap club - being in the sector that has diverged from bonds of late. Such mega caps are living in a different world from small businesses facing into tighter lending. We look at the S&P 500's trends relative to interest rates and "QE" and how large cap growth has been above other market segments over the past decade. There's still not much joy in IPO markets - especially for those who didn't sell quickly. Finally, we take a look at the decline of cash in the Australian economy and the resurgence of commercial aircraft orders. Japanese dividend yield exceeds the rest of the world for first time in 50 years

Source: Minack Advisors, Asian Century Stocks Compression of yields across assets

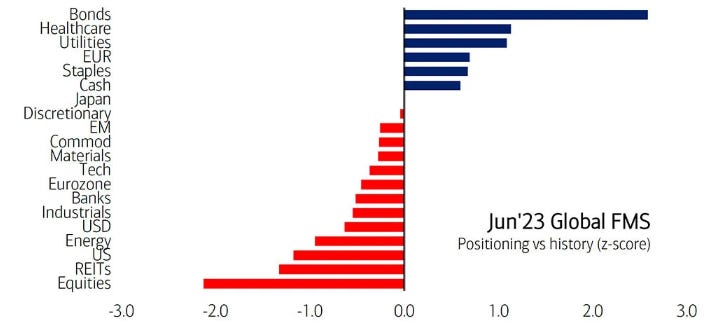

Source: Financial Times Fund Managers' bullish bonds, negative equities, relative to historical levels (June 2023 survey)

Source: Bank of America, [email protected] 33 countries have an inverted yield curves

Source: worldgovernmentbonds.com Market expectations for Fed Funds Rate (as per futures)

Source: @CharlieBilello Recent surge in price of C3.ai (Ticker "AI")

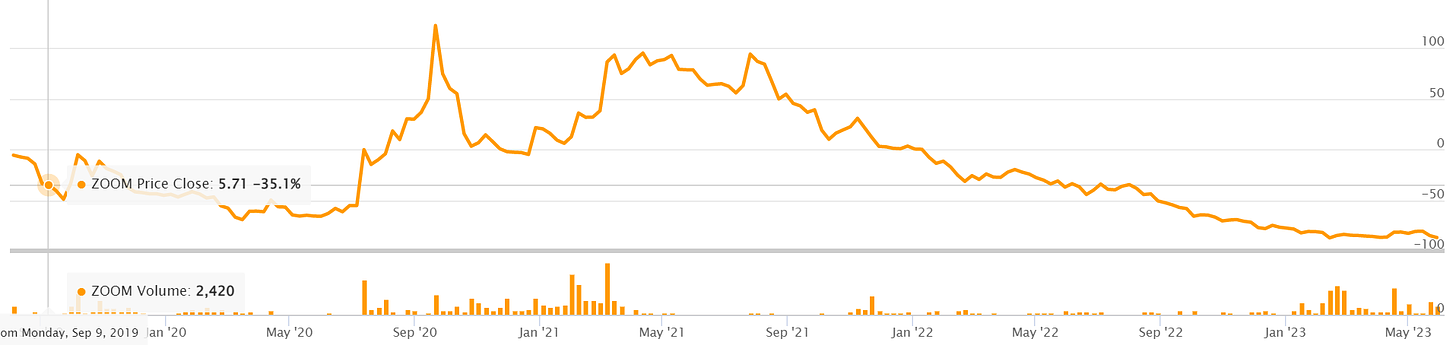

Source: TIKR Stock code "ZOOM" took off when Zoom Video Communications (ZM) surged in 2020

Source: TIKR Nvidia joins "Trillion Dollar" Market Cap Club

Source: Statista Divergence between tech valuations & bond yields

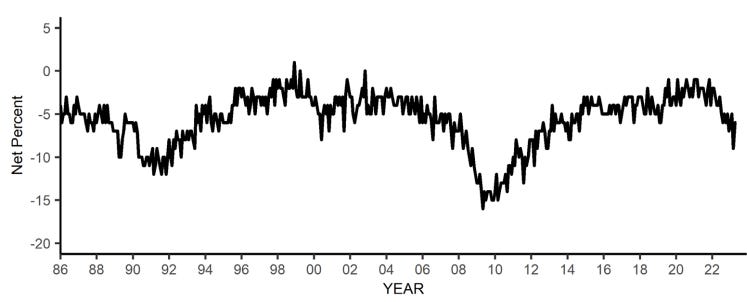

Source: Bloomberg, Koyfin Loan availability compared to three months ago

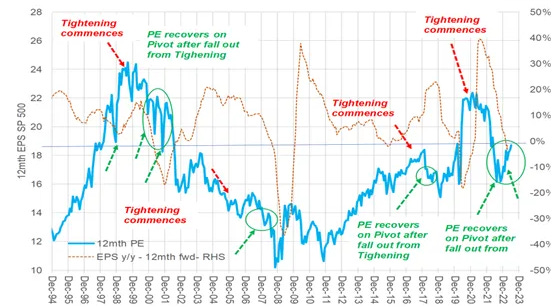

Source: NFIB Small Business Economic Trends May 2023 Fed tightening, EPS growth & PE multiple expansion/contraction

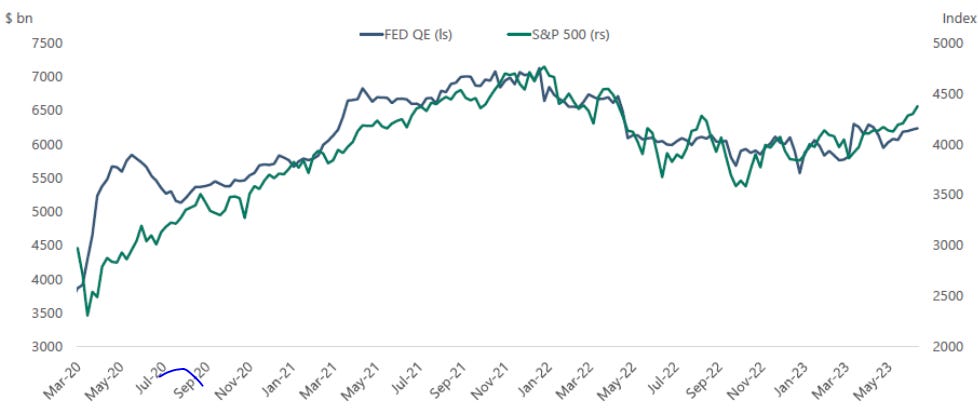

Source: @EquitOrr S&P 500 performance and Federal Reserve net Quantitative Easing (QE)

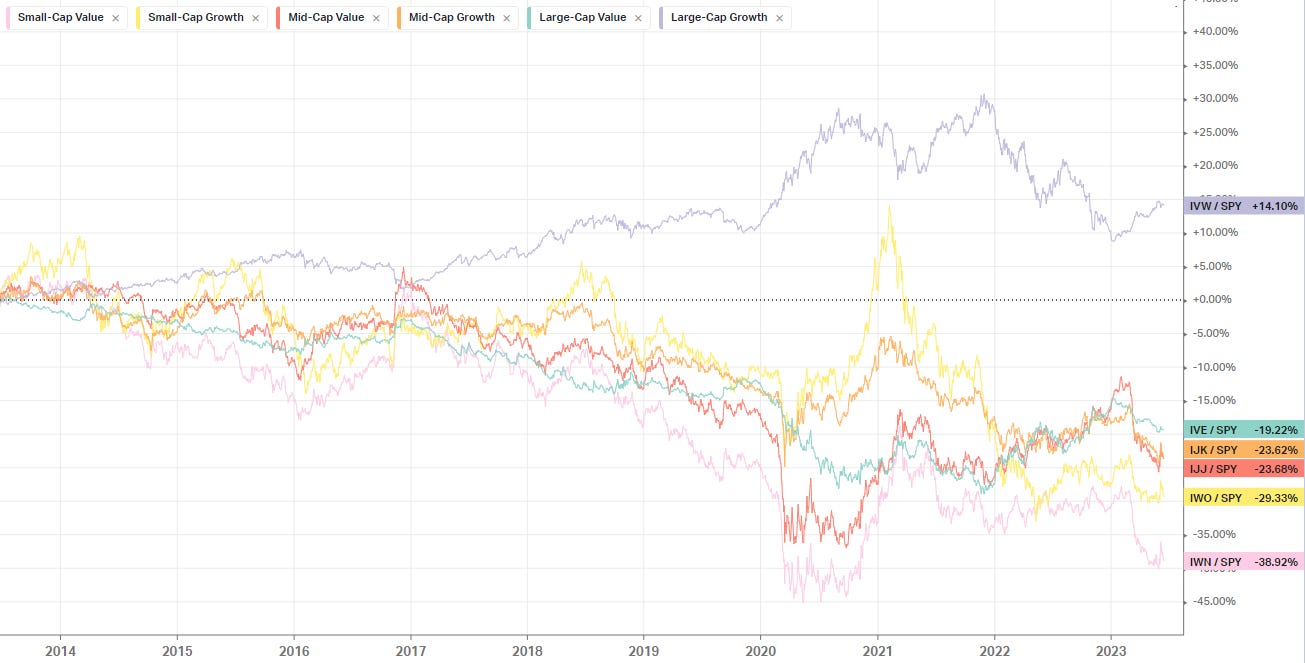

Source: Bloomberg US equities - growth v value over the past 10 years

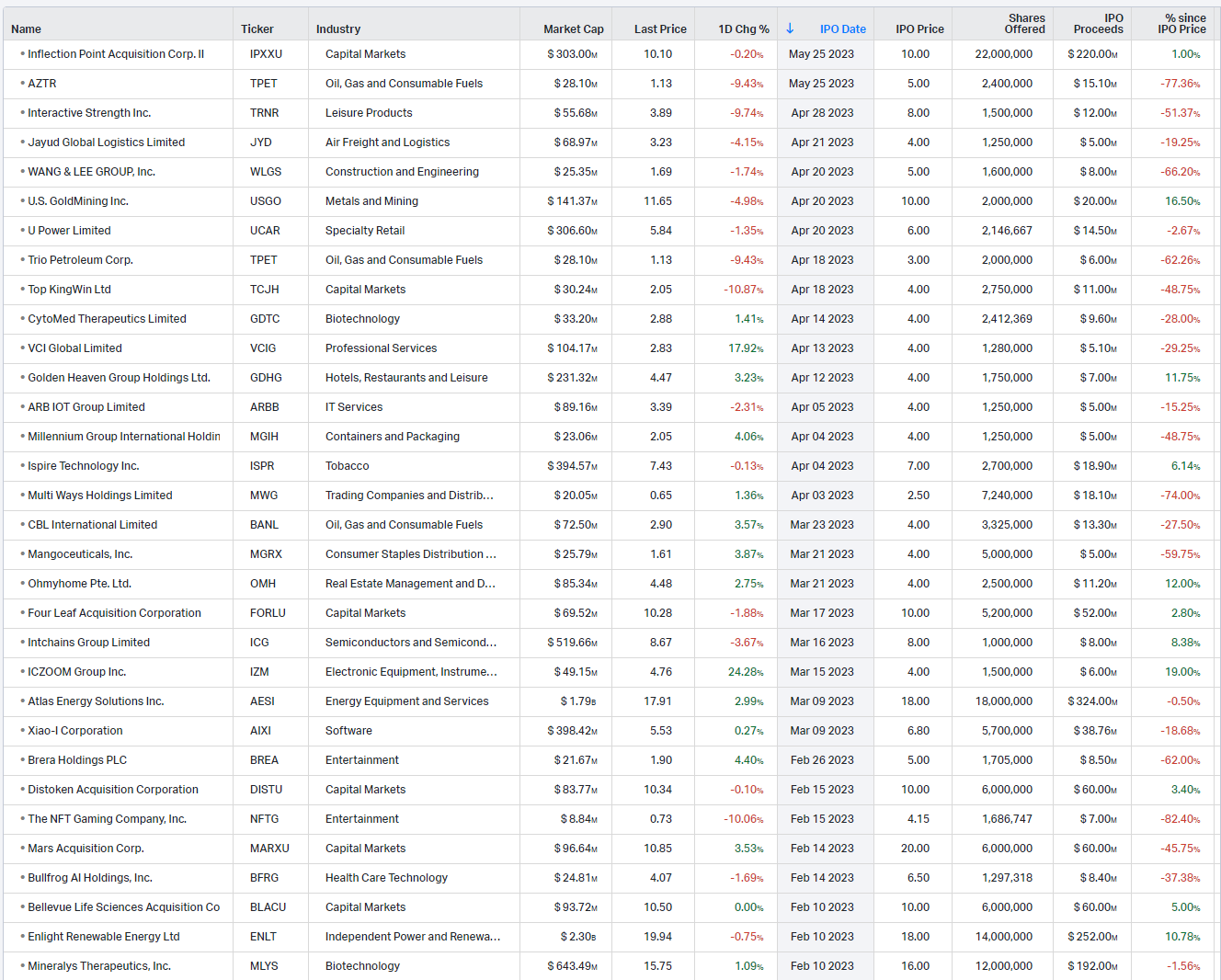

Source: Equitable Investors, Koyfin Recent US IPOs

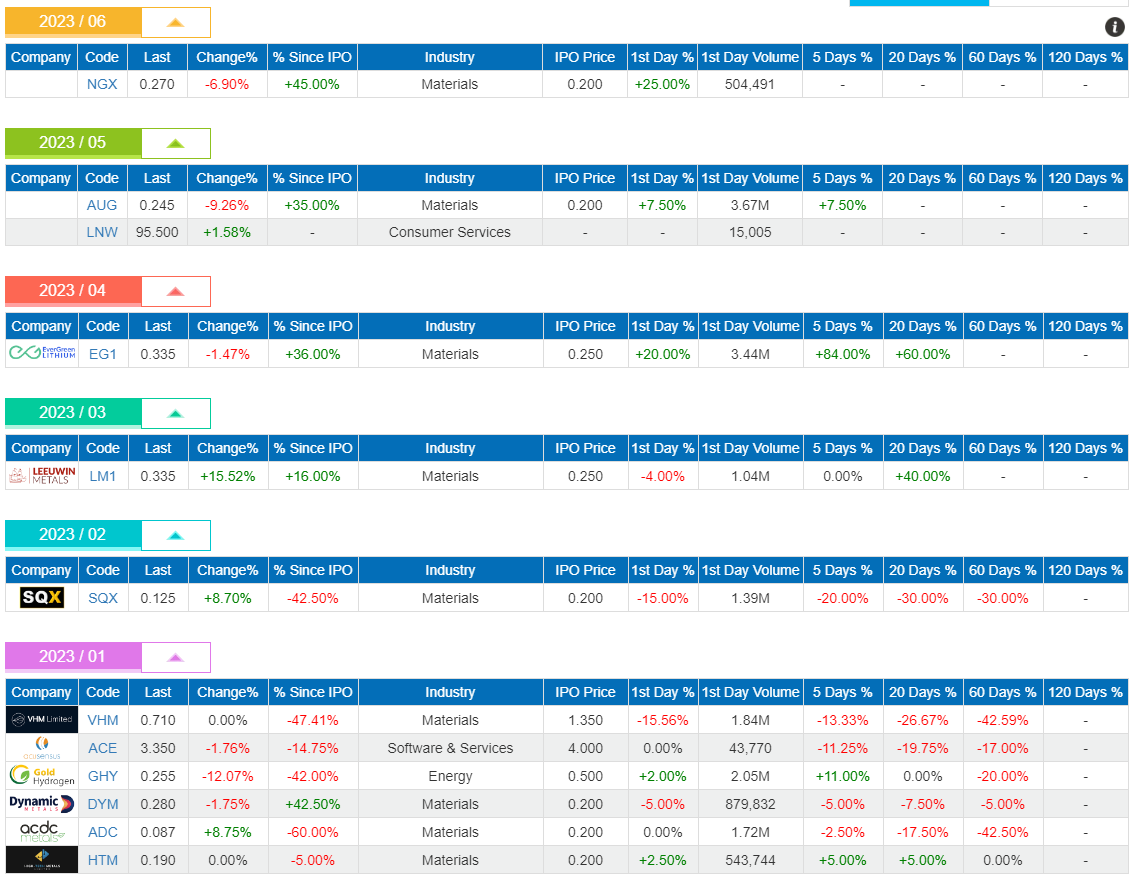

Source: Koyfin ASX IPOs in CY2023

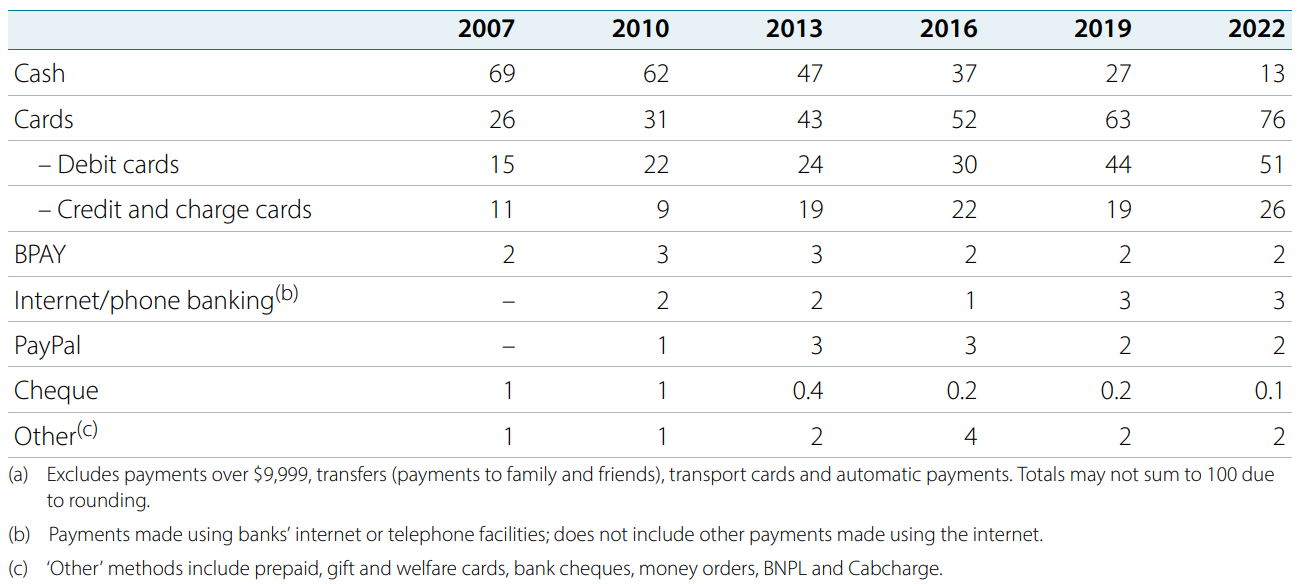

Source: 61Financial Sharp decline of cash's share of Australian payments

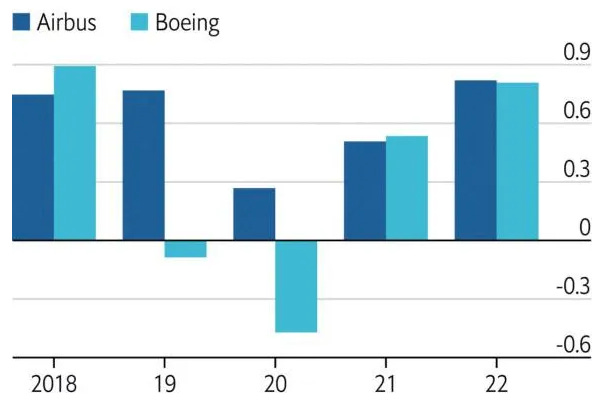

Source: RBA Net orders for commercial aircraft

Source: The Economist June Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |