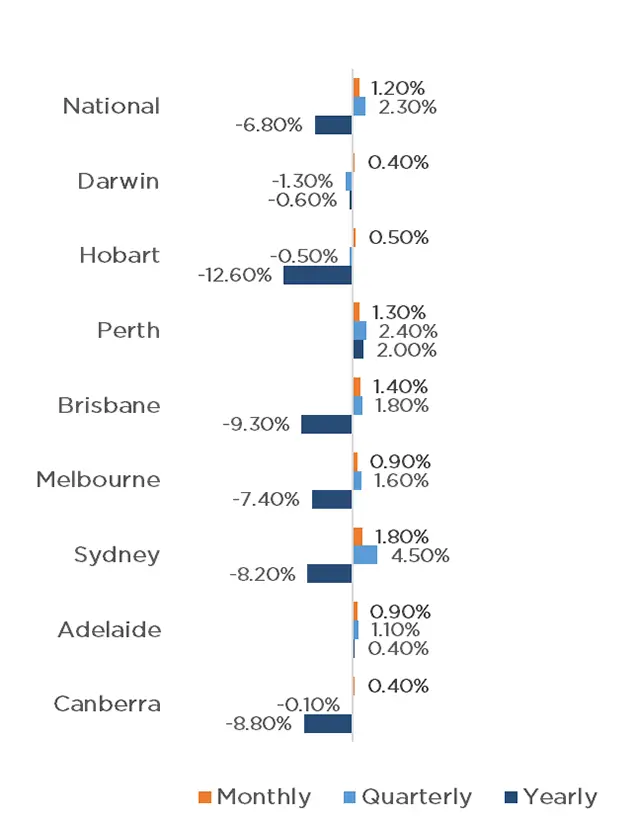

The Australian housing market continues to bounce back despite further interest rate rises, with CoreLogic's national Home Value Index rising by 1.2% in May.

The capitals and the regions both performed strongly, with all capital cities recording a month-on-month increase, and only regional Victoria decreasing.

Once again, the capital cities performed well with Sydney leading the way with a 1.8% increase, followed by Brisbane (1.4%), Perth (1.3%), Melbourne (0.9%), Adelaide (0.9%), Tasmania (0.5%), Darwin (0.4%) and Canberra (0.4%).

Performance across regional areas was also largely positive, with only Victoria experiencing a reduction in values (-0.5%). The Northern Territory and ACT, maintained values, whilst New South Wales (0.5%), Western Australia (0.5%), Tasmania (0.7%), Queensland (0.8%) and South Australia (0.9%) all experienced growth.

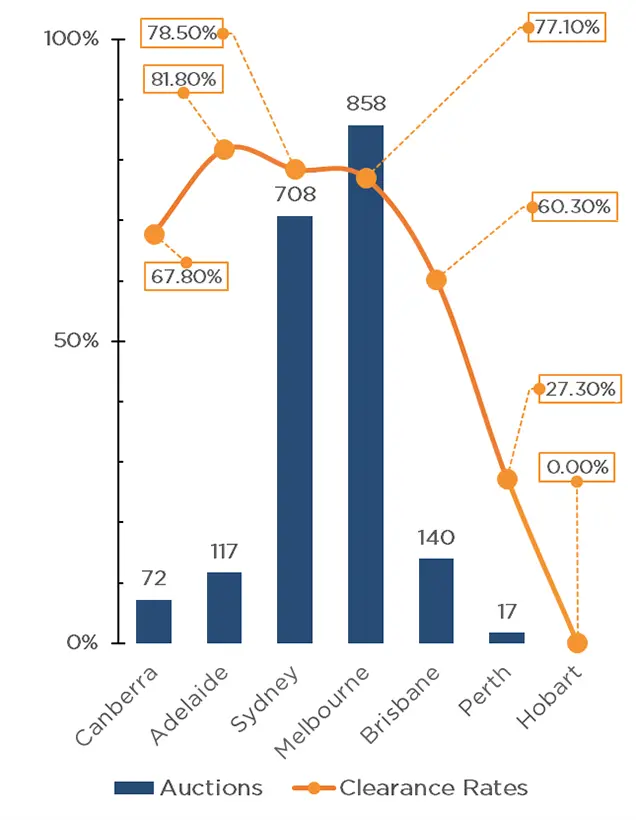

The property market continues to experience a lack of supply, with the last weekend of May holding just 1912 auctions, well below the 3226 that occurred on the same weekend in 2022. This lack of supply is likely the factor propping up property prices.

Melbourne (858) and Sydney (708) led the way with significantly more auctions taking place than the rest of the country with Brisbane (140), Adelaide (117), Canberra (72) and Perth (17) all well below previous year figures.

Whilst the total auctions were down considerably, clearance rates were exceptionally high, with a weighted average of 75.9% across the capital cities, well above the 59.3% last year. Adelaide had the highest clearance rate across the country, with 81.8% (up from 73.6% last year). Sydney and Melbourne also performed strongly with 78.5% and 77.1% respectively, well above the 56.4% and 60.4% last year. Canberra recorded 67.8% (64.4% last year) with Brisbane also outperforming last year, with 60.3% (51.2% last year). Perth was the weakest performance of the cities, with only a 27.3% clearance rate, down from 42.1% last year.

Clearance Rates & Auctions 22nd - 25th of May 2023

Property Values as at 1st of June 2023

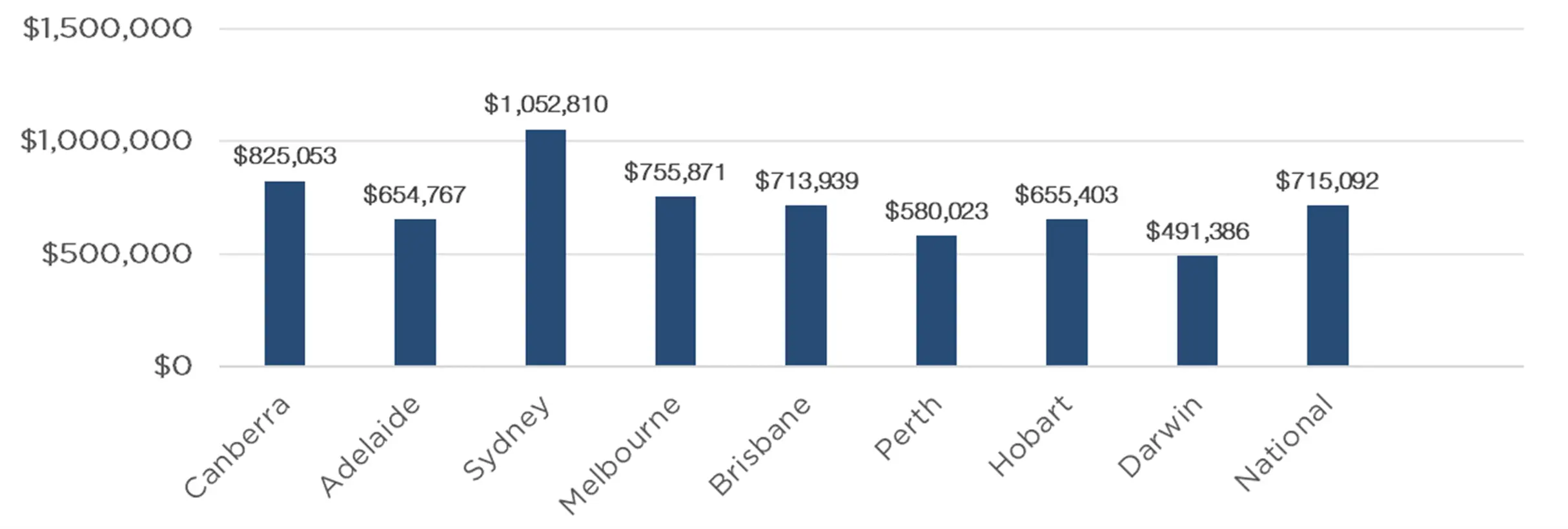

Median Dwelling Values as at 1st of June 2023

Quick Insights

Clover Moore, Closing the Door

The National Housing Finance and Investment Corporation estimates that there is a shortfall of 400,000 houses nationwide. The Sydney basin represents nearly half of this amount, and over the next decade that shortfall will worsen by another 160,000 houses.

Rising house prices have been routinely blamed on negative gearing policies, when in reality it is the inaction and onerous requirements laid on developers in the inner cities that has exacerbated the issue.

Developers have been unable to provide supply due to the conditions city bureaucrats have placed upon them.

Source: Australian Financial Review

Paperwork & Supply

National Australia Bank boss Ross McEwan has spoken out about the housing supply saying, "Housing supply is a major issue at present and without clear moves to significantly increase supply, demand will inevitably push up prices further and faster."

Mr McEwan was backed up by Lendlease's Dale Connor, Mirvac's Campbell Hanan and Charter Hall's David Harrison - who agreed that improving planning processes was the first area to target.

Mr Harrison said that, "State governments have to take more control over the planning process to create more densification."

"It's got nothing to do with negative gearing or the demand side of things - it's all about a chronic undersupply of housing stock."

Source: Australian Financial Review

Hot Terraces

In defiance of the RBA's then coming increase in rates, 8 out of 10 Sydney terrace homes put up for auction last weekend sold, the strongest result in 19 months.

As mentioned in our Market Update this was followed by a 77.2% clearance rate across the combined capital cities, the third consecutive week of robust increases.

Independent Sydney-based auctioneer Clarence White said, "Even one-bedders are selling quite well nowadays, such as the one I sold on the northern beaches last week, where we had five registered bidders. I wouldn't have seen that six months ago."

Source: Australian Financial Review

Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance