|

What to do about Stock Based Compensation? Eiger Capital April 2023 |

|

The tech sector sell-off that began in early 2022 has seen a renewed investor focus on 'disciplined growth'. We think this is investor code for a shift to positive operating free cashflows and the end of equity market funding of operating losses. Lossmaking tech is now on the nose. The equity market sell-off has also led to greater scepticism at the increasing use of alternative corporate earnings measures such as 'underlying' profits. These are often presented by companies that want to adjust (i.e. increase) statutory reported earnings for 'one-offs' and 'non-cash' items. A common adjustment of concern for investors, especially popular with companies in the tech sector is the issue of SBC. Companies are able to report higher underlying earnings (or more to the point reducing underlying losses) by using the justification that SBC is a 'non-cash' item and thus should be added back to statutory earnings. We are unconvinced with this argument as we reason below. SBC is a real cost of employment and thus should be accounted for in reported statutory earnings. Let's start with a "101" on SBC - what is it?SBC is quite simply an alternate form of compensation paid to company employees, often as a substitute for a cash salary. There are two main types. SBC is equity in the business that employees work for and is most typically issued either in the form of employee stock options or otherwise as restricted stock units (RSUs). It is common for both types of SBC to vest over a specified time period and often subject to some conditions (most commonly just tenure at the company). SBC is not a new innovation. It has been around in the US for more than 70 years. Although employee stock options did exist in the US pre-WW2 their unfavourable tax treatment meant they were little used. Very few executives had executive stock options prior to 19501. Then shortly after the war their issuance started to rise quickly with the introduction of the 1950 Revenue Act. This new law allowed for lower capital gains tax treatment on the sale of executive options. As a consequence, executive stock option issuance jumped to around 18% of top US executives remuneration, just one year later. Nevertheless, stock options remained mostly restricted to top company executives until the early 1960's. Late that decade Robert Noyce and Gordon Moore (of "Moore's law fame), two of the original founders of Fairchild Semiconductor (the inventor of the silicon chip) established a new company called Integrated Electronics. This company was later renamed Intel and was one of the first companies to use employee stock options more broadly as a tool to incentivise the staff of their new company. Once again, their use rapidly increased during the dot-com boom of the late 1990's. This popularity was again sunk by dotcom bust of 2001. Many recipients of SBC found themselves on the hook for large tax bills despite the value of their options now being mostly worthless. More recently, SBC has again blossomed with the FANG led tech bull market of the late 2010's / early 2020's. High inflation and the end of zero interest rates globally from mid 2022 has led to a tech industry selloff that has again put SBC back onto investors' radars. Why do companies issue SBC?SBC is most commonly issued to staff by early stage 'startup' tech businesses for a number of reasons.

What are the problems with SBC?There are a number of concerns for investors arising out of the payment of SBC and not just the issue of the cost of SBC not being appropriately reflected in earnings.

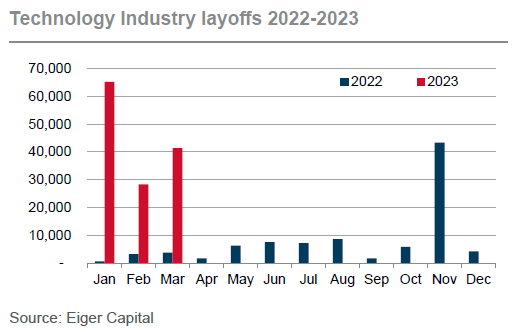

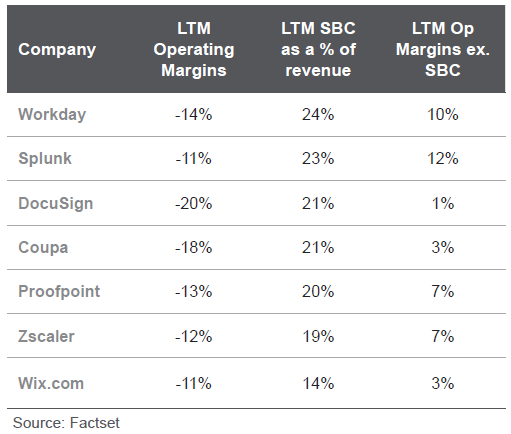

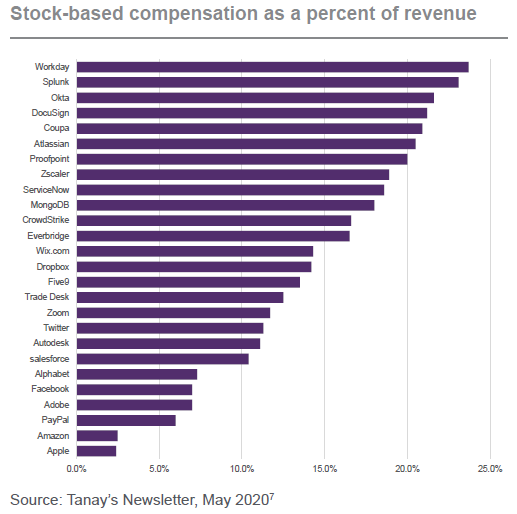

A recent Barrons3 article highlighted the now more common practice of many large companies in the tech industry. More of them are using SBC for a greater proportion of their total employee compensation. As revenue growth rates have slowed and correspondingly tech valuations have dived, this practice is increasing the anxiety of many investors who consternate at the growing ownership dilution of their business. The article points out that average stock-based compensation for the US tech industry rose from just 4.2% of revenue in 2012 to 10.5% in 2020, and then more than doubling a year later to 22.5% in 2021. At these levels SBC has moved well away from its tech industry origins as a tool to align and motivate small teams in early-stage businesses. Instead it is now "part of the culture and the expectation from software company employees"… with the consequence being that… "an increasing amount of shareholder value (is) being transferred to employees and away from investors, as companies dole out more stock at lower prices". Perhaps the most egregious recent example of the above practice has been pandemic beneficiary Zoom. SBC became very entrenched as part of employee expectations during the good times when the share price ran up from US$70 in Dec 2019 to a peak of almost US$600 (+760%) less than a year later in Oct 2020. However rolling forward to late 2022 with the share price back at US$70 (-88%), employees who unlike shareholders need to be compensated for the lower share price, requiring the company to issue significantly more SBC than when its share price was US$600.  According to Kelly Steckelberg, Zoom's CFO, this was done to ensure workers were not "feeling that they're being undervalued"4. Unfortunately this resulted in very large levels of dilution for suffering shareholders, who's feelings were apparently less important to the CFO. The one possible fly in the ointment for employee SBC is that the rising level of tech industry layoffs is eroding the current culture of expectation. If tough times continue then tech sector remuneration will undoubtedly come under more pressure. The consequences will not only be lower levels of SBC but also possibly lower levels of total absolute compensation, although evidence of the latter is yet to be seen.  Not all of the tech industry has been exploiting SBC-adjusted underlying earnings. Some of the larger profitable tech companies such as Alphabet (Google)5 and Meta (Facebook)6 have long since moved away from an 'underlying' earnings measure that excludes SBC. They recognise that it is indeed a true cost of attracting and retaining staff and account for it as a proper expense. Unfortunately many other large but still unprofitable tech companies continue to rely on SBC as an 'underlying' earnings adjustment to help hide the fact that their margins are miserable on a fully costed basis. The tables and charts below show some well-known names such as Adobe and DocuSign as the biggest serial users of SBC.   Final thoughtsWe may in the not-too-distant future see SBC returning to its origins of tech start-up land. It is here where the cost of equity dilution to investors is more than offset by the 'blue sky' value creation potential that a highly motivated and well-aligned small tech team can deliver. Author: Victor Gomes, Principal and Portfolio Manager |

|

Funds operated by this manager: Eiger Capital Australian Small Companies Fund 1 https://secfi.com/learn/history-of-employee-stock-options This material has been prepared by Eiger Capital Pty Ltd ABN 72 631 838 607 AFSL 516 751 (Eiger). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed. |