|

Is the sky really falling in?

Insync Fund Managers

July 2022

A different message for the year's mid-point...

Each month we show how we invest practically by focusing on a Megatrend, then one or two stock examples in support. Given we are halfway through the year and with so much negativity about after the last 5 months of stock price volatility, we thought a closer look at these negatives is warranted.

We will assume you are already well versed with 'the sky is falling in' commentary and opinion from elsewhere. All good decisions however come from looking at both sides.

Negativity Bias: We notice the bad far more than the good. It's why commentators lead with bad news. It gets our attention.

Cognitive Bias: We're more aware of, and seek out, information supporting our view or assessment, even if we can't point to why we have that view. As an extension, we often then block or discount information to the contrary.

Time bias: The immediate and near term has a greater weighting in how we respond than further out; even if it is counterproductive to achieving what we are seeking.

Straight Line Bias: We assume most lines and trends will continue as they are now, unabated. For example, today's inflation rate combined with negative headlines is interpreted as inflation will keep increasing.

Fear Bias: We tend to emphasise and process negative information ahead of positive information. So much so that positive news is often received with cynicism or suspicion. Fear beats positivity every time.

Inflation, recession, high interest rates.......

Commentators have espoused many things in the last 5 months, the general message swinging between ongoing crippling inflation, high interest rates, and recession. We have noticed 5 common assertions they often use, and for our investors benefit we felt it worthwhile examining each one carefully. What we discovered may surprise you, and so, remember those 5 genetic biases.

The inference is that investing in growth assets will be a risky decision and thus growth managers will face hard times. As a Quality Style manager, we are not convinced of these inferences, as what we found suggests otherwise. The details behind our reasoning can be found in our recent White Paper on this subject (on our website).

Common Assertion 1: Carbon prices will continue to rise.

- Supplies globally can easily meet demand (the potential temporary exception of gas to Europe accepted). OPEC sees oil and gas price pressures as 'transient', and not worth the expense or risk of lifting output creating oversupply.

- Net Carbon Demand continues to drop as Oil Intensity in our economies also falls (has been for the last 15 years).

- The Russian war will end, with bad news outcomes mostly factored into its price already.

- Longer term, carbon demand growth overall will be offset by green energy, emerging energy storage solutions and shrinking populations in developed nations.

- Scant evidence supports a sustained price rise above the present US $100-$120/ barrel trading range, especially as the US reopens shale extraction.

Given this, prices are not likely to either significantly increase or decrease. As carbon energy is the PRIMARY driver of key inflationary factors, should it trade around where it is now, it will fail to drive inflation further.

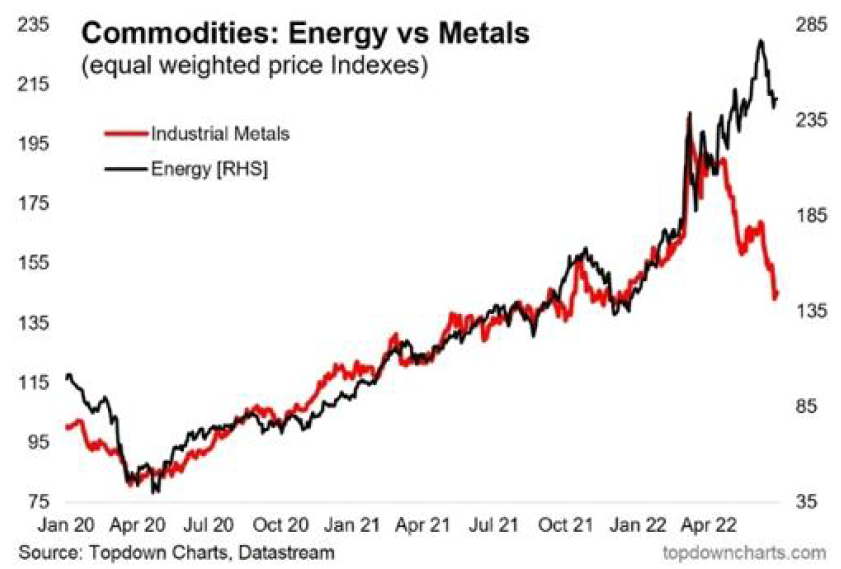

The red line in the graph shows the general basket of major commodities. They too are falling and earlier than carbon energy has. Indeed, this might not only point to a fall in inflation but to the prospects of a recession. We will address that further on.

Common Assertion 2: Global shipping supply chains are crippled and expensive.

The problem with this is that shipping capacity and efficiency is rapidly improving and prices are falling. These facts and more below.

- Next 2 years the equivalent of an additional 25% of all TEUs (6 Mn+ 20ft containers) shipping capacity in the world today will enter the water.

- Those ships are bigger and more efficient. They consume less fuel per TEU, with a very large proportion of new ships over a whopping 14,000 TEUs in size. (the largest carries 21,000 containers)

- Bottle necks are evaporating as a vaccine driven Covid BAU takes hold.

- Container costs have averaged under $2k/TEU for over a decade - Covid increased this temporarily to $10k/TEU at its peak last October.

- It's now already falling DESPITE high fuel costs.

Covid is an event based disruption- not permanent. Life resumes, blockages unblock. This is already occurring.

Common assertion 3: Reshoring back to the West means higher prices

A UBS survey of American CEOs had 90%+ intending to move production away from China. Already 6 massive multibillion dollar chip manufacturing plants are already underway in Texas and Arizona. It comes down to what's being re-shored. Goods being re-shored are mainly higher value/complex goods (e.g. technology intensive). Let's look at some further current facts:

- Multiple US tariff wars, Covid, Taiwan, Hong Kong, and now Russia - CEOs are adjusting their risk/reward calculations en masse. (There's been exponential increases in both the number of corporations both acting and planning moves).

- Re-shored goods by in large face lower transportation costs and delays, and less logistical complexity.

- Higher technology inputs utilising higher skilled labour means wage price differentials are less than previously assumed in financial models.

- White goods are already being made in the US at prices as if they were made in China (Ironically in one example Haier from China is the plant owner)

- Automation of new plants is reducing manufacturing- based wage pressures.

- No one is yet certain how much will return to major consumption centres (beyond strategic goods such as chip manufacturing and rare-earth mining) but indications are clear that it's a significant amount.

There are emerging spin-off benefits, not previously factored in, that offset nearshoring or reshoring costs; for example massive construction activity for rehousing all this manufacturing, along with the support industries providing the new equipment for them. US facility construction soared 116% in the last year, dwarfing the 10% gain on all other construction combined.

This move may will assist western economies increased resilience to geo-political events of the future (meaning more stable prices and supply).

Common assertion 4: The US economy is faltering, and now from the Russian war, the EU is too.

There are several arguments entwined in this, and so we shall try to be brief, knowing we have a fuller answer contained in our White Paper.

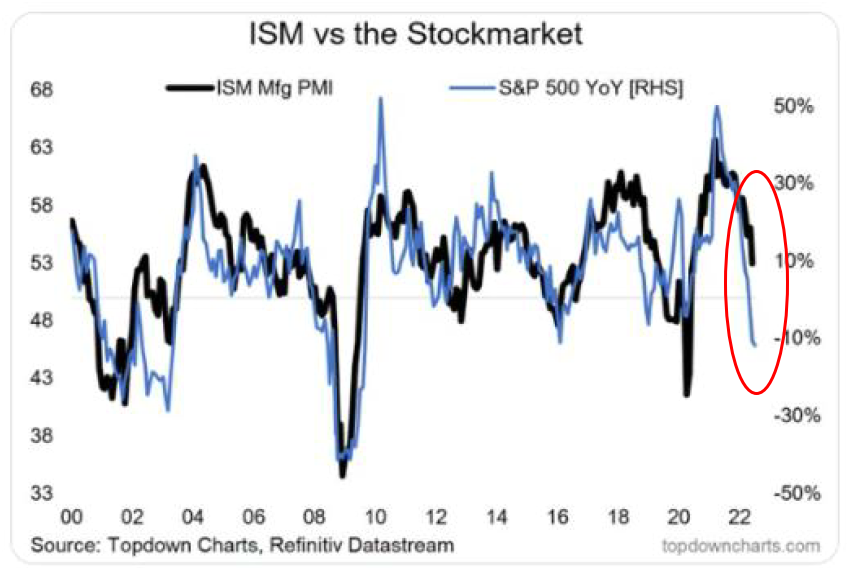

That red circle in the graph shows a critical historical disparity. The market has overshot the negative and is out of kilter with the 300 odd critical US businesses purchasing managers that this reliable benchmark survey covers. Investors are already expecting the US economy to contract, yet importantly not to the extent that it did during the pandemic, the GFC or the 2000 recession.

Despite all the news headlines, US hourly wage growth is exceeding the inflation of goods and services (ex food and energy). Real wages are growing at (a moderate) 1.7% pace, maintaining a healthy demand for labour and not too much of a concern for the Federal Reserve. Given the low labour participation rate, there is little chance that we see wages driving inflation. This is what would concern the Federal Reserve, as unit labour cost growth is the real source of endemic inflation.

Until the Russian war ends the EU is in for a bumpy ride- short term no doubt, but there will be positive surprises as is already evident.

Common assertion 5: Ever increasing interest rates.

Bond markets basically set the future of interest rates and particularly in the US. So, let's take a closer look at what they are telling us. Their expectations after allowing for inflation, energy and commodities prices, geopolitics etc. says the next 5 years will top at 2.55% and the 5yr-10yr expectation at 2.14%.

Let's say that again... 2.55% and 2.14%.

From this we can gauge the expectations for 10 years which currently stands at 2.35%.

Clearly interest rate rise expectations, are actually rapidly declining. This has implications for how much more the Federal Reserve is likely to tighten. Whilst there is sound basis to argue that the Fed Fund Rate is too low, it is unlikely to be lifted more than 3.5% due to the combined effect of slowing GDP growth and peaking shorter term inflationary expectations. Long term inflation averages a little over 3%, yet in the last 10 or so years, we got used to a once in a lifetime decade of ultra- low rates. Life, markets, consumers and companies adjust. This level of inflation is not bad for growth assets.

Funds operated by this manager:

Insync Global Capital Aware Fund, Insync Global Quality Equity Fund

Disclaimer

Equity Trustees Limited ("EQT") (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Insync Global Quality Fund and the Insync Global Capital Aware Fund. EQT is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). This information has been prepared by Insync Funds Management Pty Ltd (ABN 29 125 092 677, AFSL 322891) ("Insync"), to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Insync, EQT nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.

|