It will be of no surprise (or joy) for readers to hear that market conditions deteriorated significantly from May with indices across all asset classes and geographies diving into the end of the financial year to 30 June 2022.

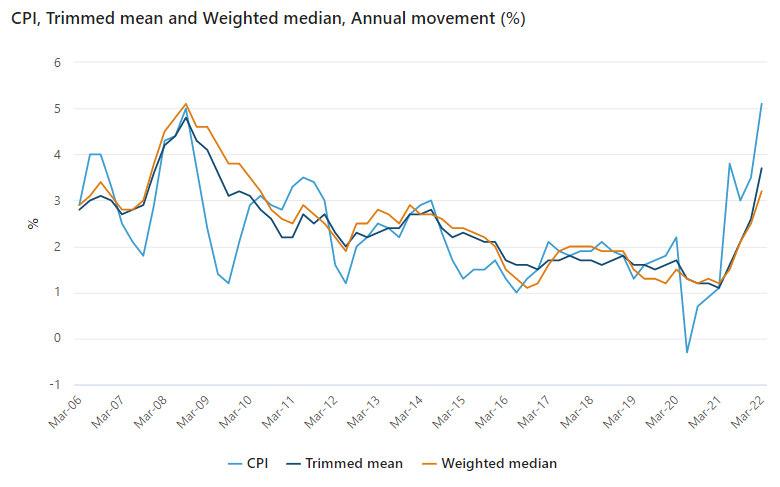

Domestic inflation at a 13 year high, central bank rate rises (RBA's cash rate has moved from 0.10% to 1.35% since April), property market weakness, record fuel prices and slides in global markets, combined with substantial tax-loss selling conspired to create almost the perfect storm, particularly at the smaller end of the ASX.

Most of these issues were mirrored in other developed economies, with the US stock market enduring its worst six month start to a calendar year in more than 50 years.

The All Ordinaries slid 9.4% in June (outside of the start of Covid-19 this was the worst monthly fall since the GFC of 2008), the S&P/ASX Small Industrials Index fell 10.0% whilst the S&P/ASX Emerging Companies Index was decimated, down 18.6%.

Outlook

It is clearly easy to feel 'bashed around' of late given the severity and quantum of the market's falls. Importantly, we have positioned the portfolio to be invested in companies that have been well capitalised to endure any downturn.

The past few weeks we've been getting out and visiting both our existing and other companies that we have either previously invested in or that may have the potential to be new investments. What's clear, almost across the board, is that 'on the ground' there is nothing like the levels of pessimism that the ASX is presently reflecting. Yes, there continue to be some operating challenges in certain sectors, accompanies by dented consumer and business confidence, but the share price declines have priced in significant earnings declines in many cases. Of course, companies with stretched balance sheets will remain in a difficult position while the stock market is bearish, but the levels of true 'value' creeping into stock prices presently is extremely attractive.

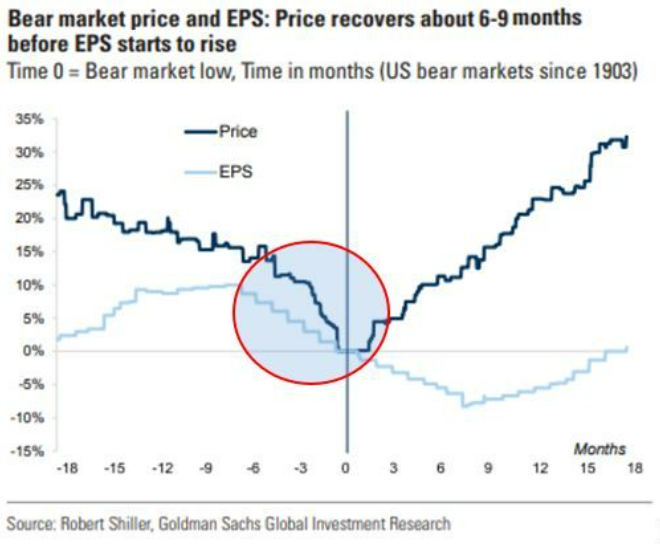

It is worth remembering that the market always looks forward and any rebound in price is, historically, likely to precede improvements in earnings. The chart below shows the S&P rebounds from a bear market 6-9 months ahead of a turnaround in earnings.

We have been investing for many decades and we know that the best time to invest is when the market is at peak panic. Of course, this is not always easy to do, nobody rings a bell at the bottom, but from what we're seeing and hearing, our company outlooks are far better than the market prices are currently implying and as such we remain particularly confident that the prices of our holdings will improve significantly in the near-term.

To date in July, we've seen a significant rebound in prices post 30 June tax-loss selling and the Cyan C3G Fund has experienced a material uplift in its NAV.

|