|

What has changed in the property market in China?

Our view is that the property sector will face continued structural headwinds as the government continues upon its path to "common prosperity". The days of supernormal profits for developers are over. In saying this, the earnings of developers will be less cyclical than before, but at a lower level.

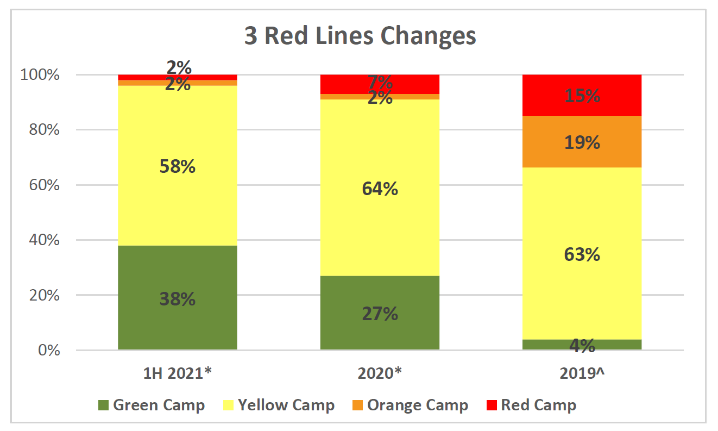

The key trigger for this viewpoint is the introduction of the three red line rules which effectively act as debt covenants for property developers. These lines are:

- Liability to asset ratio (excluding advance receipts) of less than 70%

- Net Gearing Ratio of less than 100%

- Cash to short-term debt ratio of more than 1

Breaching any of these three red lines shines a bad light on the developer with regards to capital management and over-extension by a function of high levels of debt. It will also lead to developers facing challenges in re-financing debt in the future.

Since the introduction you can see a material change in strategy by developers. They have reduced debt in a meaningful way - over 1/3 of property developers breach no red lines compared to 2019 figures.

What exposure do the Premium China and Premium Asia Equity Funds hold in the property sector?

The Premium China and Premium Asia Fund hold very low levels of exposure to the Property market (~4% PCF, ~2% PAF) as at end August 2021 (note that it was also ~4% PCF, ~2% PAF in August 2020). Furthermore, a majority of the holdings are in property services company as opposed to developers. As you recall, we are bottom up and don't focus on overweight/underweight against benchmark.

What exposure does the Premium Asia Income Fund hold in the property sector?

The Premium Asia Income Fund holds no exposure to Evergrande and never has.

From an indirect perspective the fund itself has strategically reduced its exposure to the broader property market over recent years. From ~67% ending August 2019 down to ~46% ending August 2020 and as of 20/9/2021 ~26%. The remaining property exposures are diversified across 15-20 holdings, none of which exhibit any credit risk both from a coupon nor capital return perspective.

From a tactical perspective in order to shield investors from the mark to market movements, the Fixed Income team reduced the $USD/AUD hedge from 77% to 35% in anticipation of short-term volatility on 20/9/2021. We expect higher volatility to come through this week. This volatility has also been exacerbated by the Mid-Autumn Festival in China which saw the onshore markets in China closed on Monday and Tuesday (they will reopen today) and Hong Kong will be offline on Wednesday. Usually the offshore credit market takes its lead from the onshore, but given it was offline, there was a little bit of "sell down ask questions later" mentality by global players.

We are undeterred by MTM movements, as we've seen this cycle before. In fact, the FI team took the opportunity to rotate into a few selected names which dropped to attractive valuations (all in the 90s).

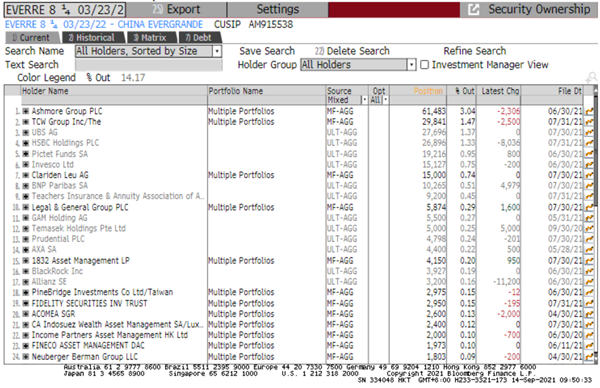

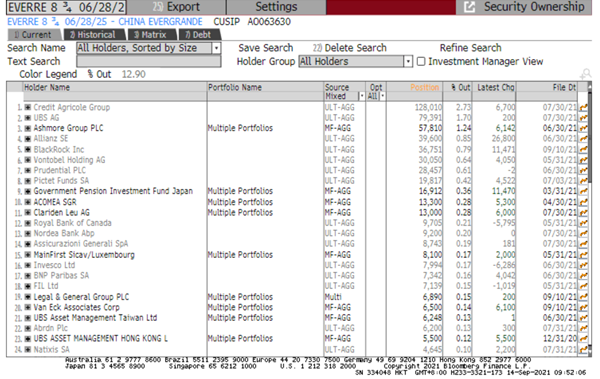

From a global viewpoint it is interesting to observe who are the largest holders of Evergrande bonds.

The FI team believes Evergrande will not receive direct Chinese government assistance, as it would be a counter-intuitive message to the private sector that the govt will always save you. In saying that, half of the Chinese banking system is govt owned/backed so they would ensure an orderly potential restructure of the debt which would be a mix of debt extensions and coupon haircuts (which would then lead to write downs).

We believe that it would be better for the sector in the medium/long term if Evergrande collapsed. The critical goal of the govt is not to save the company but to ensure properties are delivered to those who purchased them. Selling off the sites of Evergrande to other developers would secure this goal and show the public the govt will make good on the goal of common prosperity.

As we have said in the past, never underestimate the Chinese government's capability of ringfencing an Evergrande fallout from the broader economy.

The fund currently has 10% cash, and the team sees this as a good amount of dry powder looking for opportunities to deploy where appropriate. Note we acted in a similar way during the COVID liquidity crunch in March 2020. The situation is different, but our focus and goal is not, i.e. - to find good quality names undervalued or oversold by the market which will deliver a strong cash yield with some level of capital gains across a diversified portfolio.

Managers Insights | Premium China Funds Management

09:40 - Jonathan Wu explains the rationale for property holdings

11:00 - Jonathan Wu touches on debt restrictions placed by the Chinese Government

11:40 - Reduction of property exposure from 65% to 22%

12:00 - Where to in the future? Areas that offer potential growth.

|